Section 45X Resources

Expert insights and guidance on Section 45X tax credits and clean energy manufacturing

Featured Article

Complete Guide to Section 45X Tax Credits

A comprehensive overview of Section 45X tax credits, eligibility requirements, and how to maximize your benefits.

Latest Articles

20 articles found • Page 1 of 4

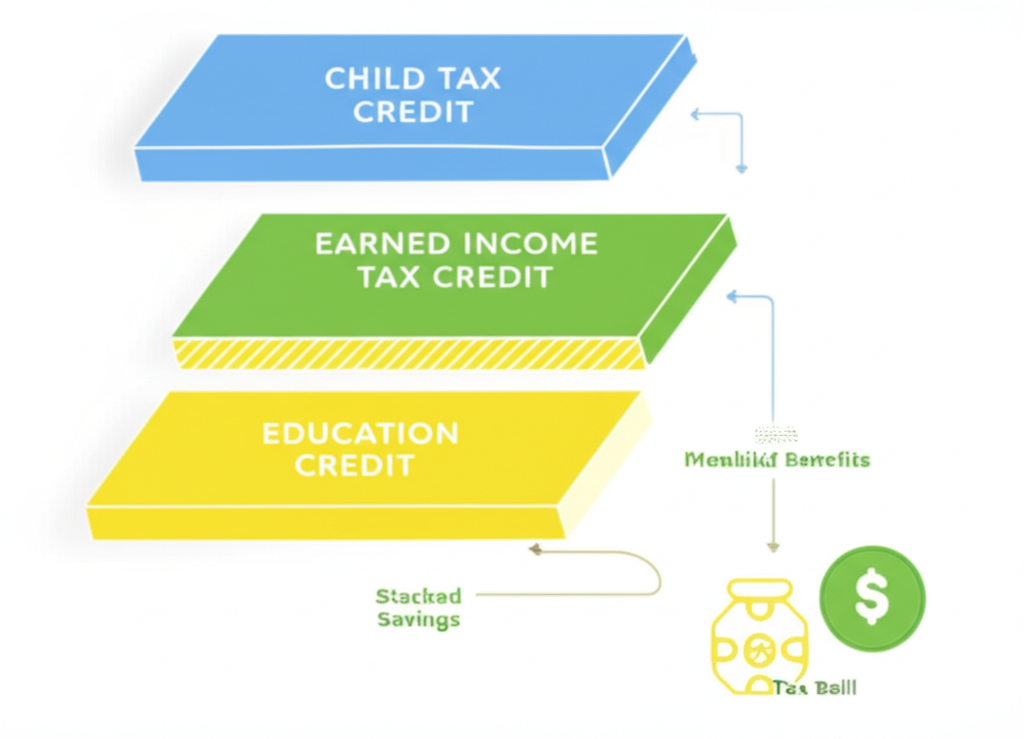

Tax Credit Stacking: Combining Section 45X with Other IRA Incentives

Learn how to strategically combine Section 45X with other IRA tax credits to maximize your clean energy manufacturing incentives.

Read More

Monetizing Section 45X Credits: Options for Manufacturers

Explore different strategies for monetizing Section 45X tax credits, including transferability, direct pay, and partnership structures.

Read More

Understanding Domestic Content Requirements for Section 45X

Learn about the domestic content requirements for Section 45X tax credits and how they impact your manufacturing operations.

Read More

Documentation Best Practices for Section 45X Compliance

Discover the essential documentation practices to ensure compliance with Section 45X requirements and prepare for potential audits.

Read More

Preparing for IRS Audits: Section 45X Compliance Checklist

A comprehensive checklist to help manufacturers prepare for potential IRS audits of Section 45X tax credit claims.

Read MoreStay Updated on Section 45X Developments

Subscribe to our newsletter to receive the latest updates, insights, and guidance on Section 45X tax credits and clean energy manufacturing.